As the U.S. economy enters a new political era, the commercial construction sector is at a crossroads. Much of the recent growth—particularly in manufacturing, logistics, and clean energy—was seeded by federal investment during the Biden Administration. But with the 2024 election reshaping Washington, the future trajectory of construction will depend on how the Trump Administration approaches trade, regulation, and industrial policy.

Understanding where things are headed requires understanding where we’ve been. Over the past five years, the industry has undergone dramatic shifts. Following the onset of the COVID-19 pandemic, residential construction surged while commercial construction plummeted amid widespread shutdowns and economic uncertainty. Since then, the dynamic has reversed: residential activity has cooled, while commercial construction—especially in infrastructure and industrial sectors—has rebounded.

To better understand these evolving trends, researchers at Twisted Nail—a Texas-based construction aggregate supplier—analyzed national and state-level data from the U.S. Census Bureau. The report examines how private nonresidential construction spending has changed over time, which sectors are expanding most rapidly, and which states are leading the way.

Trends in Commercial Construction Spending

Source: Twisted Nail analysis of U.S. Census Bureau data | Image Credit: Twisted Nail

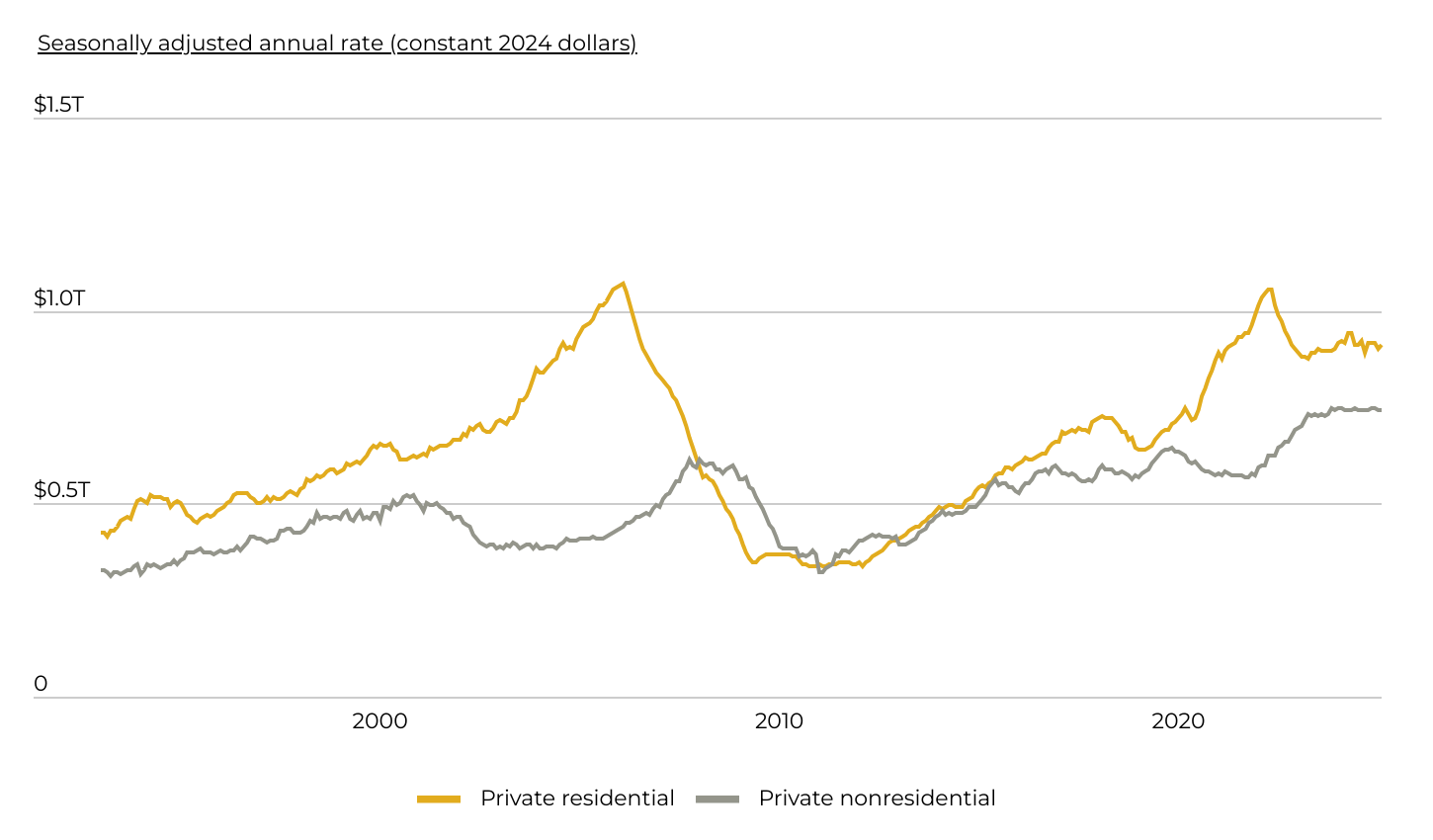

Commercial construction was hit hard by the Great Recession, with investment falling sharply after peaking in the mid-2000s. For much of the following decade, spending remained well below its 2007 high. However, unlike residential construction—which still lags behind its pre-recession peak—commercial spending briefly surpassed its 2007 record just before the start of the COVID-19 pandemic.

That progress was short-lived. Between early 2020 and the end of 2021, commercial construction declined steadily as the pandemic reduced demand for new projects, falling from about $633 billion to $569 billion (in 2024 dollars). The rebound, however, was swift. Fueled by the return to in-person activity and major federal investments, spending surged through 2022 and 2023, reaching over $740 billion by early 2025—the highest level in more than two decades.

Commercial Construction Growth by Sector

Source: Twisted Nail analysis of U.S. Census Bureau data | Image Credit: Twisted Nail

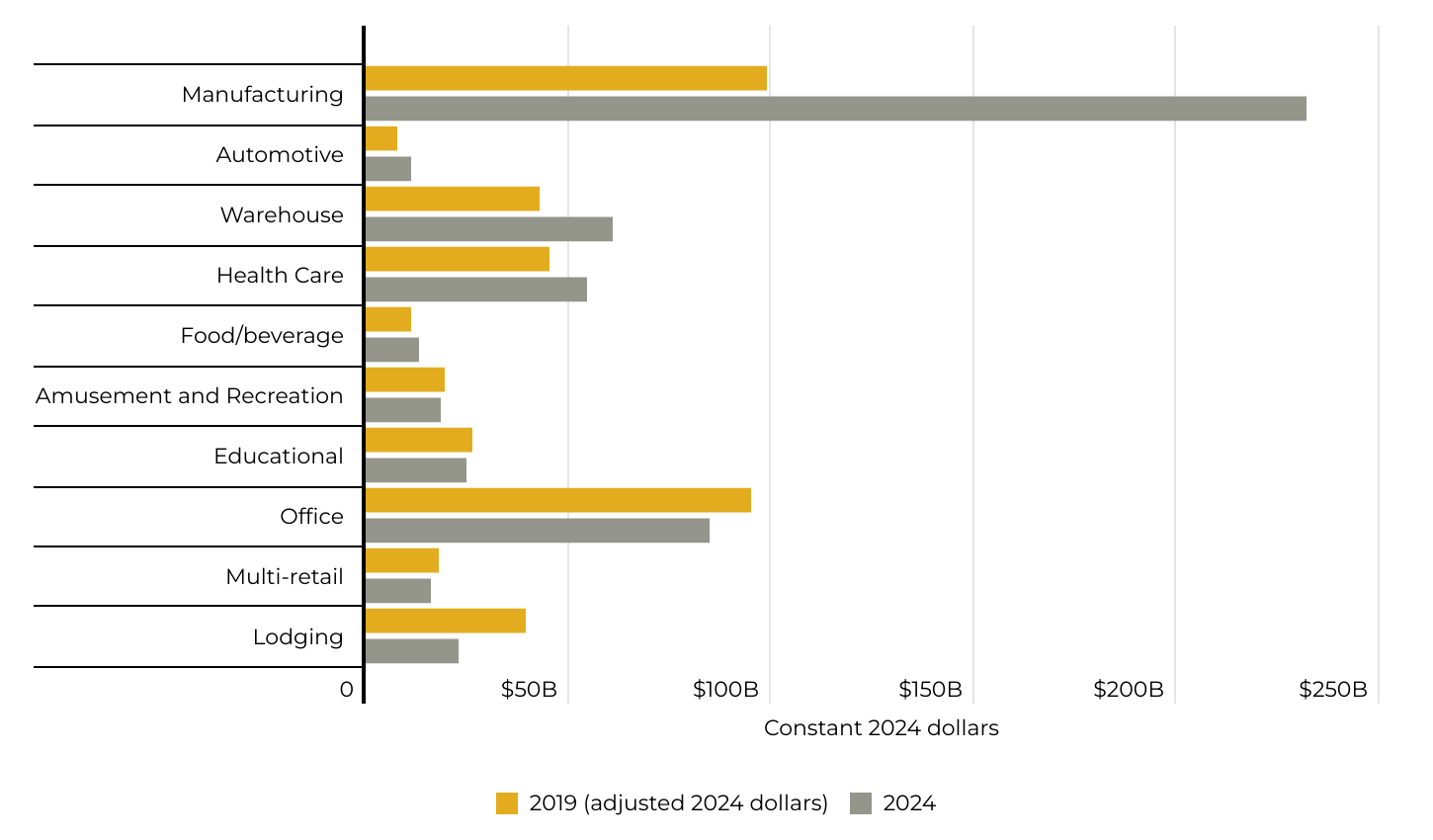

Recent commercial construction growth has varied widely by sector. Manufacturing is experiencing the largest growth, with spending more than doubling from $98.8 billion in 2019 to $232.1 billion in 2024—a 135% inflation-adjusted surge—driven by federal incentives promoting domestic production. Warehouse and automotive construction are also seeing strong gains, rising 42.7% and 47.6%, respectively, as companies expand logistics infrastructure and reshore parts of their supply chains. Health care and food and beverage projects are growing more modestly, but remain on an upward trajectory.

In contrast, several traditionally strong sectors are continuing to decline. Despite a partial return to in-person work, office construction is down by 10.8%, with demand still trailing pre-pandemic levels. Lodging is experiencing the steepest drop of all, down 42.6% since 2019, underscoring the pandemic’s long-term impact on hospitality and related projects.

Commercial Construction Spending by State

Source: Twisted Nail analysis of U.S. Census Bureau data | Image Credit: Twisted Nail

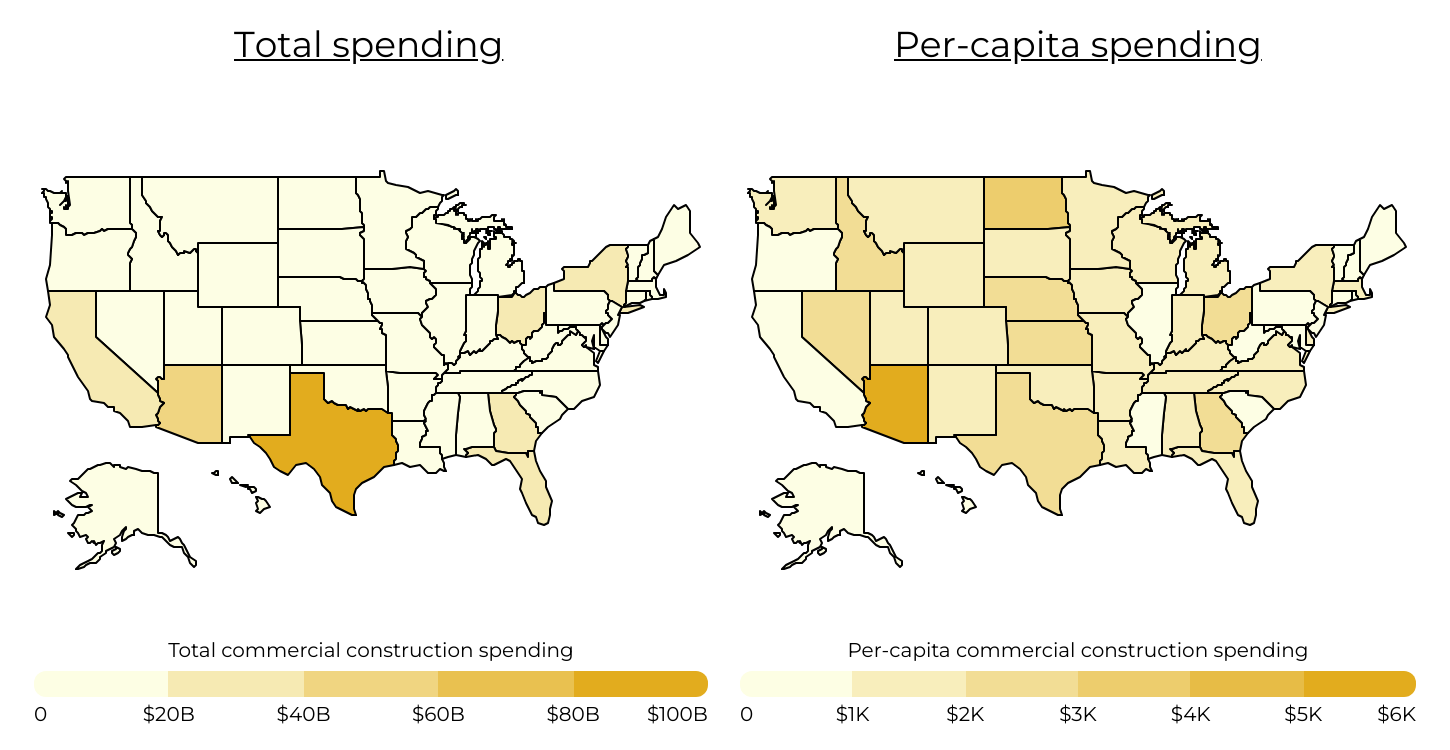

When it comes to total commercial construction activity, the Sun Belt region stands out. States across the South and Southwest have seen a surge in development in recent years, driven by population growth, pro-business policies, and large-scale investments in logistics and manufacturing. Texas leads the nation by a wide margin, with nearly $90 billion in annual commercial construction spending—more than double the total of any other state.

What’s especially notable is that Texas also ranks third nationally in per-capita spending, at $2,941, despite being the second most populous state. This places it behind only Arizona ($5,980) and North Dakota ($3,088), signaling that Texas is not just building more in absolute terms, but is also investing heavily relative to its population. Arizona’s high per-capita figure reflects major semiconductor and high-tech manufacturing projects, while smaller states like Idaho ($2,852) rank highly due to mega projects like Meta’s new Kuna Data Center.

Other populous states—Florida ($34.1 billion), California ($33.6 billion), and New York ($30.3 billion)—still report high levels of total commercial construction spending, but rank lower on a per capita basis. This contrast underscores the growing role of certain smaller or fast-growing states in driving commercial construction activity, particularly in sectors benefiting from recent economic and policy shifts.

Looking Ahead: What’s Next for Commercial Construction?

Photo Credit: Bluedog Studio / Shutterstock

The past few years have reshaped commercial construction in the U.S., shifting investment toward sectors like manufacturing, warehousing, and automotive—and toward Sun Belt states where development conditions are most favorable. But the outlook for 2025 and beyond will be shaped by a different set of pressures and priorities.

First, federal investment will continue to play a critical role. Many projects funded through federal legislation passed under the Biden administration are just entering the construction phase. These include major developments in clean energy, semiconductors, and advanced manufacturing. As a result, sectors that have already seen major growth—especially manufacturing—should continue to expand, provided federal funding persists. The impact will be concentrated in regions like Texas, Arizona, and the Midwest, where infrastructure, workforce availability, zoning, and land access support these legislative priorities.

Second, supply chain resilience remains a top concern. With new tariffs rolling out and geopolitical tensions escalating, companies are prioritizing logistics infrastructure and regional distribution capacity. For instance, Prologis, the world’s largest warehouse developer, reported that demand for U.S. warehouse space is expected to grow as businesses move to de-risk supply chains and bring inventory closer to end consumers. This points to sustained demand for warehouse construction, freight terminals, and distribution centers—all of which rely on foundational materials like stone, sand, and gravel, as well as efficient trucking networks to keep projects on schedule and within budget.

Third, the potential expansion of tariffs could indirectly affect the pace of construction. While core inputs like aggregates are sourced almost entirely domestically and face minimal direct tariff exposure, many other critical materials—such as wood, steel, aluminum, and manufactured building components—are heavily imported. If tariffs increase the cost of these inputs, developers may delay or downsize projects, which could eventually dampen demand for U.S.-produced materials. The result is a ripple effect: even material suppliers shielded from tariffs may feel the impact if construction activity slows more broadly.

Meanwhile, sectors that have already been slow may face further headwinds. A potential economic slowdown, reduced consumer spending power, and the administration’s ongoing disputes with education institutions could suppress demand in categories like office, lodging, education, retail, and recreation. If these more speculative sectors remain soft, developers are likely to shift their focus toward projects that are more resilient to market volatility.

Taken together, these trends suggest a rebalancing in commercial construction activity—and a heightened sense of uncertainty. As developers, suppliers, and contractors prepare for changes that are likely on the horizon, flexibility will be critical. For materials suppliers and logistics partners, this means navigating a landscape where demand could swing sharply based on new tariff, infrastructure, and energy policies. Whether that translates to a new boom—or a slowdown—will depend not only on market forces, but on decisions made in Washington in the months ahead.

For additional information and complete results, see the original post on Twisted Nail: States Investing Most in Commercial Construction.

Methodology

Photo Credit: K-FK / Shutterstock

This analysis uses data from two primary sources: the U.S. Census Bureau’s Value of Construction Put in Place Survey and the American Community Survey (ACS) 1-Year Estimates. To identify the states investing most in commercial construction, researchers at Twisted Nail ranked all 50 states based on per-capita commercial construction spending. Additional metrics considered in the analysis include total commercial construction spending, five-year changes in commercial construction activity (both nominal and inflation-adjusted), and five-year population growth.

For the purposes of this study, “commercial construction” refers to all private nonresidential construction projects, excluding those in the power, communication, and rail sectors. The analysis incorporates the most recent data available: national time series data through 2025, national-level sector data from 2019 to 2024, and state-level statistics covering 2018 to 2023.

For complete results, see States Investing Most in Commercial Construction on Twisted Nail.