Interest rates have become a central concern for both homebuyers and policymakers. The Federal Reserve’s ongoing effort to curb inflation has led to higher borrowing costs, with rates staying elevated longer than many analysts anticipated. This shift has made mortgages significantly more expensive, complicating the path to homeownership for many Americans.

While higher interest rates have somewhat cooled the housing market, they have also driven up the cost to finance a home purchase. As a result, prospective buyers are increasingly caught in a difficult position—facing both elevated home prices and borrowing costs. In this environment, the mortgage rate a buyer can secure has become an important factor in determining housing affordability across different U.S. markets.

Trends in Mortgage Rates

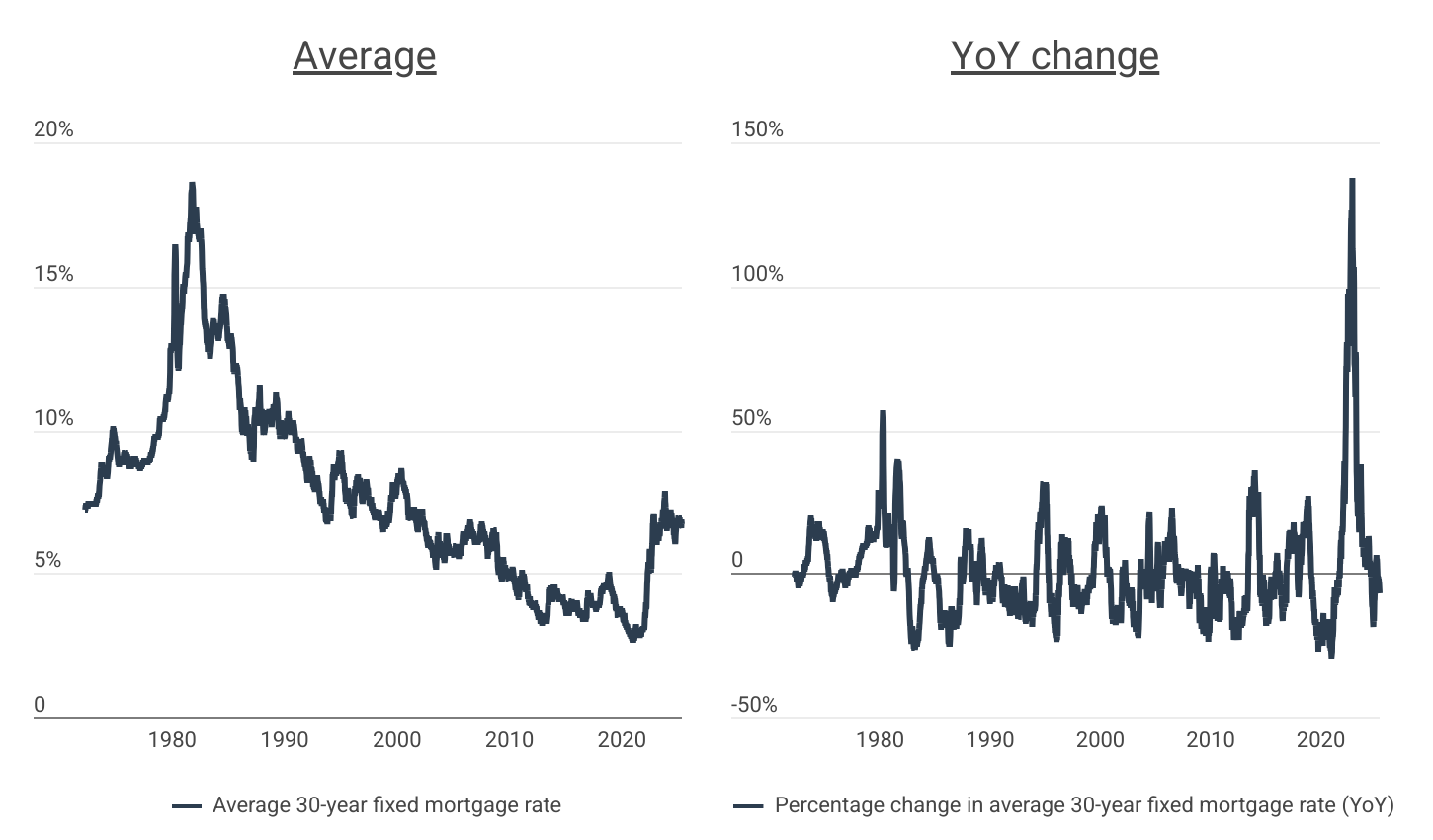

Mortgage interest rates have leveled-off after rising at their fastest pace in more than 50 years

Source: Construction Coverage analysis of Freddie Mac data | Image Credit: Construction Coverage

After climbing to a staggering 18.63% in the early 1980s, the average 30-year fixed mortgage interest rate steadily declined for nearly four decades. This long-term downward trend resulted in a historic low of 2.65% in early 2021, driven by both a long period of falling inflation and pandemic-era monetary stimulus.

That period of low inflation came to an abrupt end in the wake of the COVID-19 pandemic. Supply chain disruptions, labor shortages, and expansive fiscal policy contributed to the sharpest price increases in decades. In response, the Federal Reserve launched a series of aggressive interest rate hikes aimed at curbing price growth. Mortgage rates rose rapidly—reaching 7.79% by October 2023—before settling into a range between 6.6% and 7.0% in early 2025.

While current rates remain well below the highs of the 1980s, the speed of the increase has been unprecedented. In November 2022, the year-over-year increase in mortgage rates peaked at 138%—far outpacing the roughly 50% increase seen during the early 1980s. The result has been a dramatic reduction in housing affordability: the estimated monthly mortgage payment for a median-priced U.S. home is now nearly 60% higher than it was just three years ago, primarily due to increased borrowing costs.

Mortgage Rates by Location

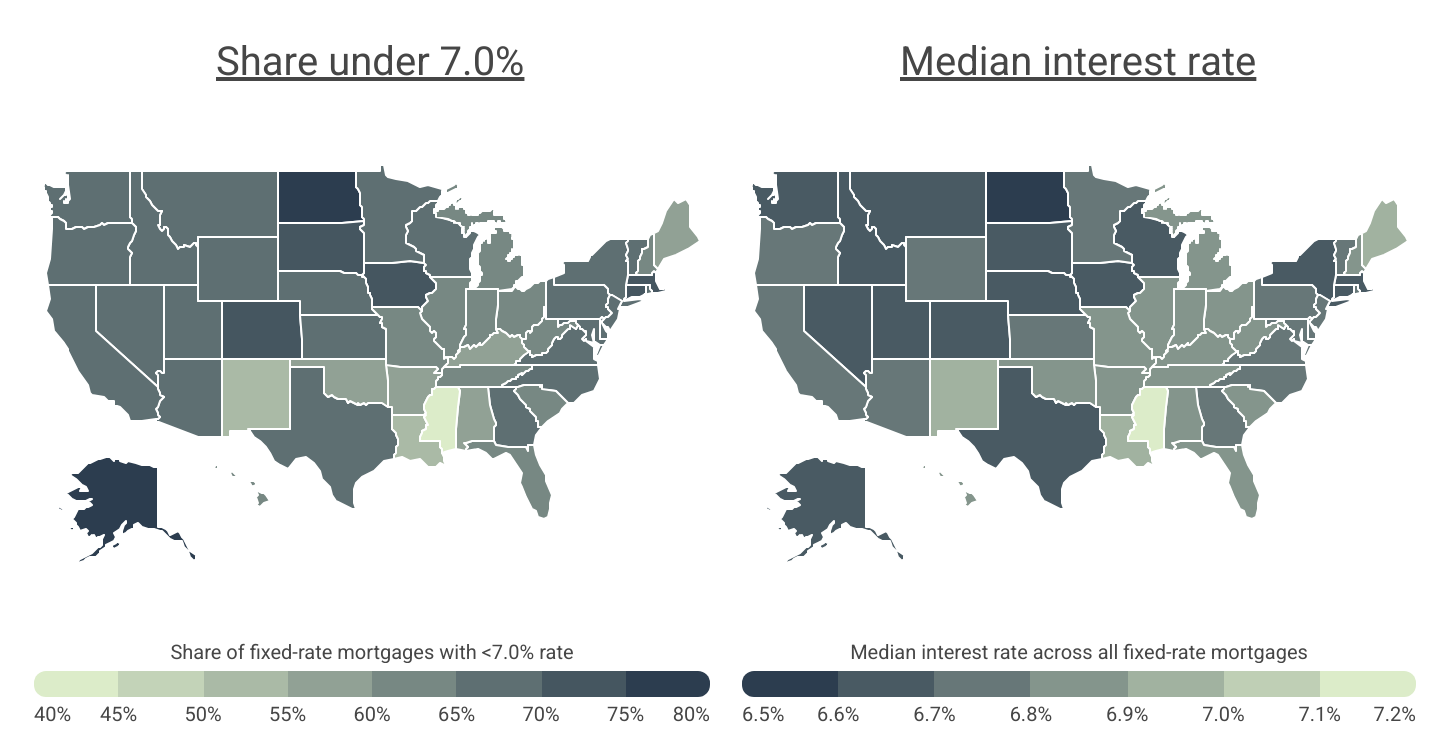

Homebuyers in Alaska and North Dakota landed the best mortgage rates in 2024

Source: Construction Coverage analysis of Freddie Mac data | Image Credit: Construction Coverage

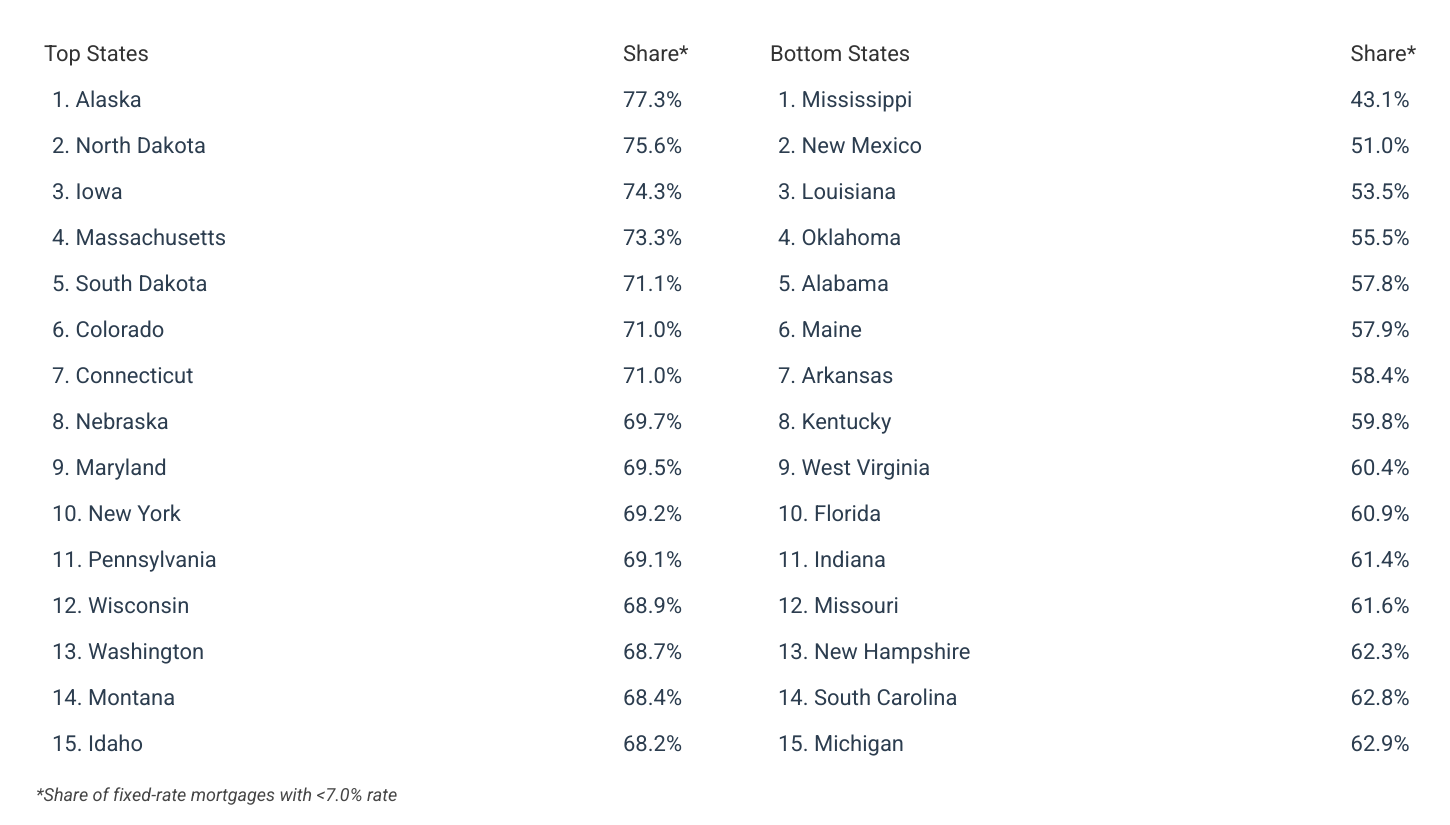

Interest rates vary geographically due to local market conditions, the financial health of residents, and laws governing lenders. Across the U.S., 65.1% of all approved home purchase loans had interest rates below 7% in 2024. Yet, the likelihood of securing a more favorable rate differed significantly by location.

At the state level, buyers in Alaska and North Dakota were most successful in locking in lower rates. In Alaska, 77.3% of fixed-rate mortgages approved in 2024 had rates under 7%, while in North Dakota, the figure was 75.6%. In contrast, Southern states tended to fare worse. Mississippi, for example, had the lowest share of sub-7% mortgages in the country, with just 43.1% of approved loans falling below that threshold.

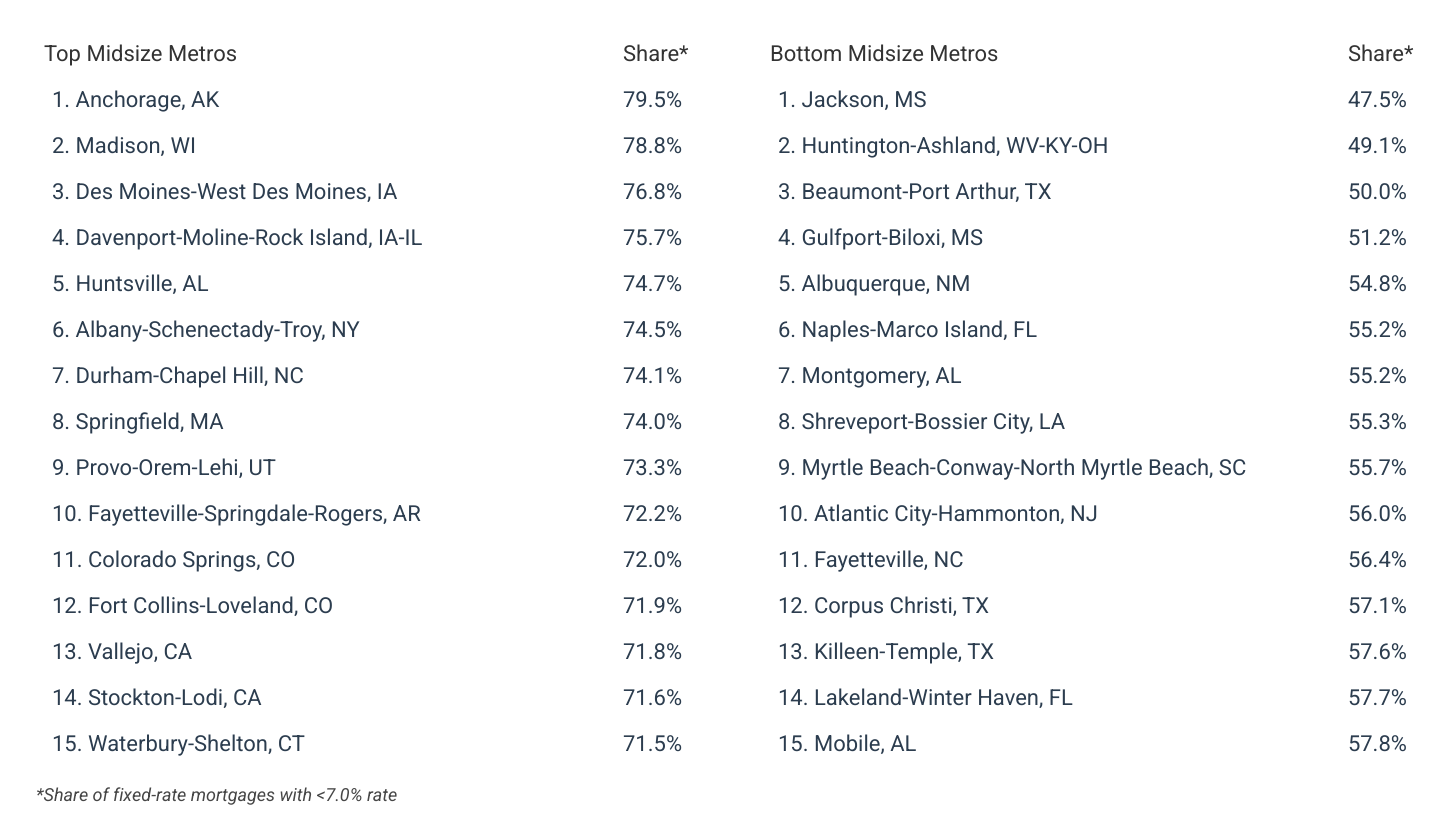

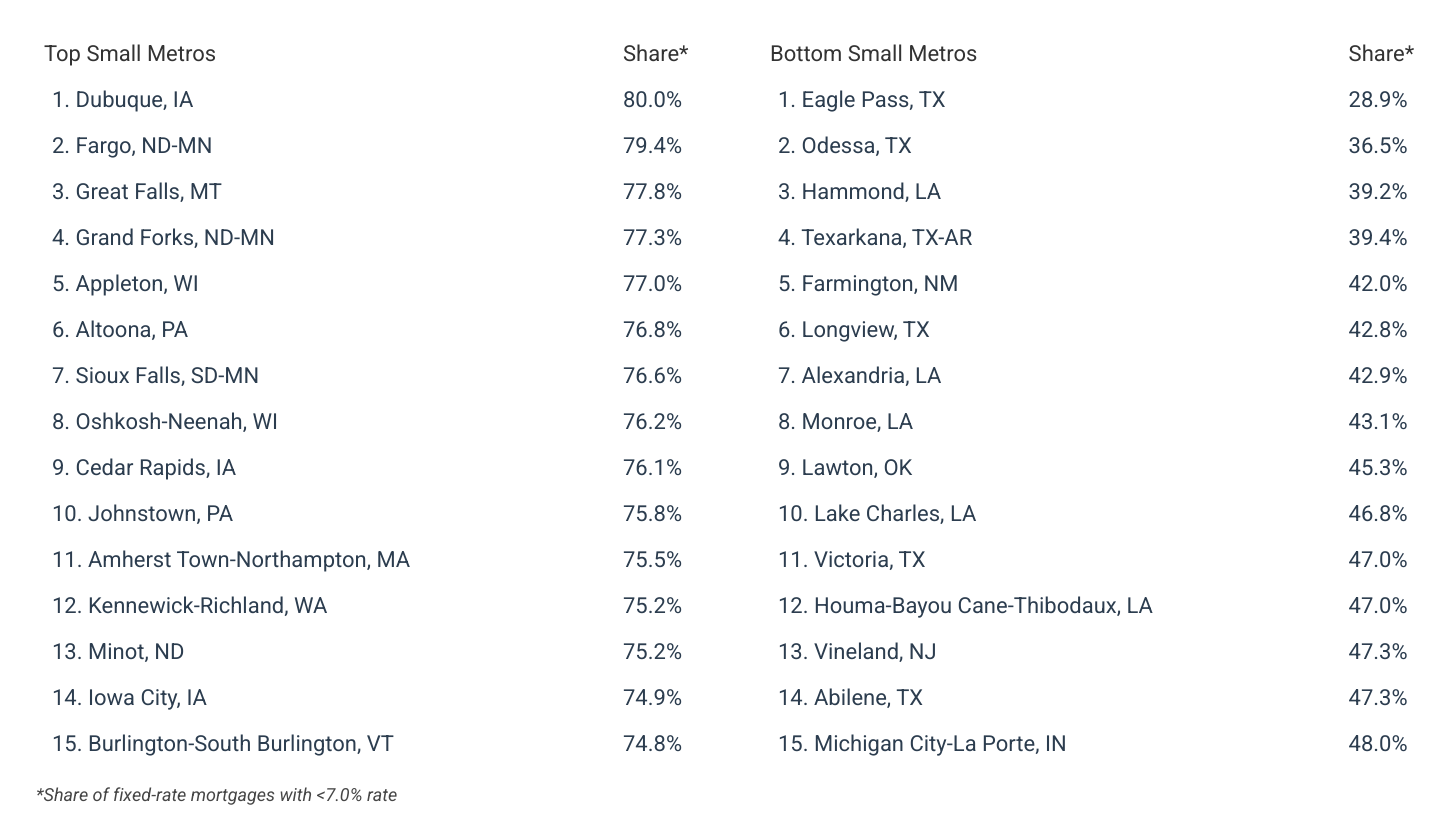

Local-level data mirrors these broader regional patterns. Several Southern metropolitan areas recorded some of the least favorable borrowing conditions in the nation. In Eagle Pass, TX, only 28.9% of buyers obtained rates below 7%—the lowest share of any metro area. Meanwhile, markets such as Madison, WI and Anchorage, AK stood out for their high share of sub-7% loans, with nearly 80% of borrowers in those cities securing lower rates.

This analysis was performed by researchers at Construction Coverage, a company that publishes original research on construction industry trends, analyzed the latest data from the 2024 Home Mortgage Disclosure Act. For detailed information on data sources and calculations, see the methodology section.

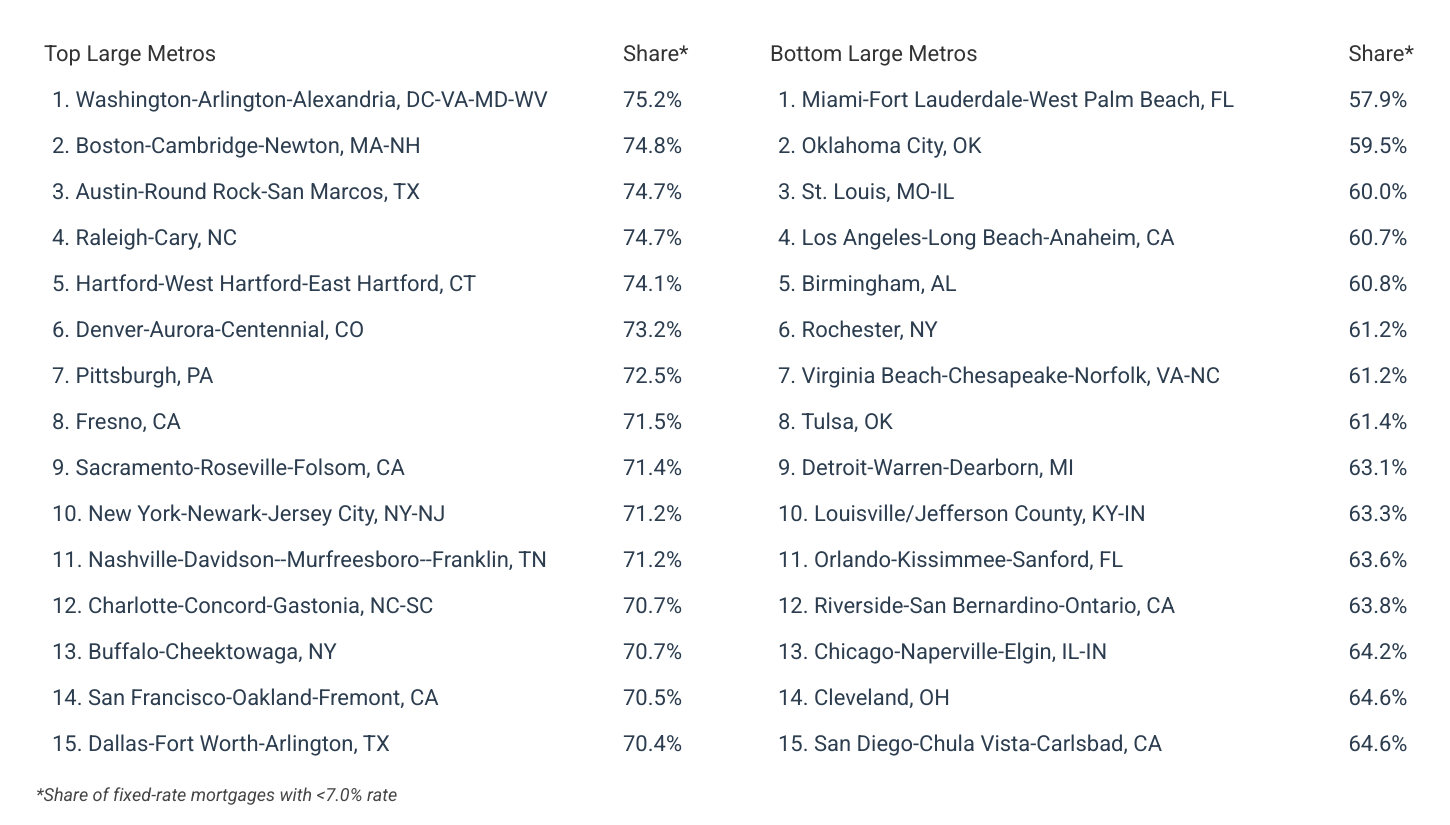

Below is a breakdown of the home mortgage rate landscape for the top and bottom U.S. metros and states. For the full results, see the original post on Construction Coverage: Homebuyers in These U.S. Cities Get the Best Mortgage Rates.

Cities With the Best Mortgage Rates

States With the Best Mortgage Rates

Methodology

Photo Credit: Tab62 / Shutterstock

To determine the locations where homebuyers get the best mortgage interest rates, researchers at Construction Coverage analyzed the latest data from the Federal Financial Institutions Examination Council’s 2024 Home Mortgage Disclosure Act. The researchers ranked metros according to the share of all fixed-rate mortgages with less than a 7% interest rate. Only conventional home purchase loans approved in 2024 were included in the analysis. In the event of a tie, the metro with the greater share of 30-year mortgages with less than a 7% interest rate was ranked higher. Researchers also calculated the share of 15-year mortgages with less than a 7% rate, and the median interest rate across all fixed-rate mortgages, the change in median interest rate across all fixed-rate mortgages (2023–2024), and the median home sale prices for homes financed with 30-year and 15-year mortgages.

To improve relevance, only records with complete data were included in the analysis, and metro areas were grouped into the following cohorts based on population size:

- Small metros: less than 350,000

- Midsize metros: 350,000–999,999

- Large metros: 1,000,000 or more

Additionally, due to data limitations, calculations for metropolitan areas in Connecticut were approximated using county boundaries instead of county equivalent planning regions.

For complete results, see Homebuyers in These U.S. Cities Get the Best Mortgage Rates on Construction Coverage.